- Home

- Career Counseling

- Bharat

- Editorials

- Research

- Religion and Culture

- Corporate (Business News )

- State News Update

- Crimes News

- Education News

- Property News

- mocktest

- Life Style

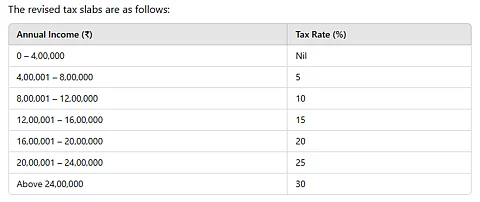

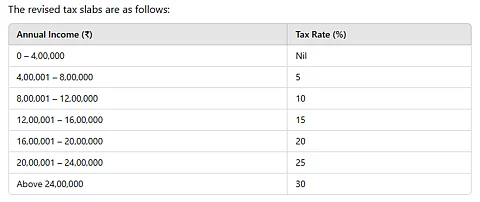

In a landmark move to bolster the middle class and stimulate economic growth, India's Finance Minister, Nirmala Sitharaman, announced a significant increase in the income tax exemption limit during the Union Budget presentation on February 1, 2025. Under the new tax regime, individuals with an annual income of up to ₹12 lakh will be exempt from paying income tax.

For salaried individuals, the standard deduction has been increased to ₹75,000, effectively making income up to ₹12.75 lakh tax-free.

This initiative is expected to enhance disposable incomes, thereby boosting consumption and savings among middle-class households. The government estimates an annual revenue loss of approximately ₹1 lakh crore due to this tax relief but believes the move will invigorate domestic demand amid global economic uncertainties.

Industry leaders have lauded the initiative. Kamal Bali, President and Managing Director of Volvo Group India, noted that the tax cuts would result in significant savings for personal taxpayers, thereby increasing discretionary spending.

However, some analysts, including Christian de Guzman from Moody's, have expressed concerns about constrained revenue growth despite the emphasis on capital expenditure.

These measures reflect the government's commitment to supporting the middle class and revitalizing the economy through increased consumer spending.

The mainstream media establishment doesn’t want us to survive, but you can help us continue running the show by making a voluntary contribution. Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed to date.

happy to Help 9920654232@upi